332,000 +

Band Raiting

96%

TrustPilot

40%

AskGamblers

60%

CasinoGuru

23%

Analytics & Statistics

Want the real numbers behind Ignition Casino? Explore Spins, Satisfaction rates, Bonuses, and more. Uncover the hidden data!

Slots

Blackjack

Roulette

Jackpot

Live Dealer

Curaçao

India, Indonesia, Thailand, United Kingdom, Vietnam

English

Real Time Gaming, BGaming, Lightning Box, Spinomenal, Genesis Gaming, Spadegaming, Revolver Gaming

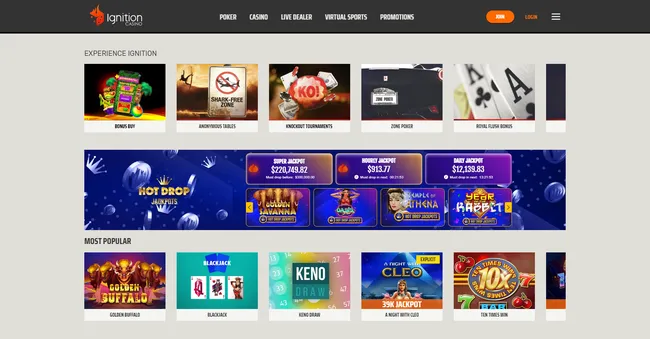

Ignition Casino is licensed and regulated out of Curacao. When you compare this with some of its competitors like Slots.lv, which has its unique features, or Bovada, known for its player base, Ignition Casino holds its ground with distinguishing characteristics.

Diving into its numbers tells a compelling story. With over 345,000 visitors per month, averaging 832 minutes per session, there's a clear indication of its popularity. Moreover, the average bet size stands at a modest $3.56 suggesting that most players approach their gaming sessions with caution and prudence.

While Vave may have similar statistics, it's the unique offerings and player experiences that set each casino apart.

While every casino, including Ignition and its rivals like LTC Casino and Fairspin, has areas to refine, Ignition makes a concerted effort to stand with its community by offering a transparent, player-friendly platform.

Our principal focus will be Ignition Casino, evaluating its metrics against indicators of transparency and fair play.

Ignition holds a license from the Curaçao Government, a widely adopted framework in the industry. However, Curaçao has faced criticism for loose enforcement. Still, transparent licensing is preferable to entirely unlicensed sites. Meanwhile, Ignition lists its owning company, suggesting conformity to reporting requirements.

With over 345,000 monthly visitors spending nearly 832 minutes per session, Ignition enjoys strong engagement. Its 49,680,000 million monthly spins indicates an active slot player base. While Ignition doesn’t disclose revenues, projection sites estimate over $5 million, implying a healthy operation.

Ignition cites an average bet of $3.56 per user, with a 46.06% / 27.87% / 26.07% split between high, low and medium volatility games. This suggests a casual player profile suited to penny slots. Players betting the maximum 4.61% of the time shows most avoid high-stakes games. The volatility split indicates an emphasis on simpler, low-risk games.

Ignition’s player retention metrics are mixed. While 44.98% use bonuses, only 33.11% complete playthrough requirements to withdraw winnings. This below-average conversion indicates bonuses may not foster loyalty effectively. The site retains only 27.4% of new registrations as active players, although existing players seem habituated with 5.57% deposits monthly.

Ignition’s stated 95% payback rate is promising, suggesting low house edge and potential profits for skilled players. Peak play from 9pm to midnight implies recreational evening gamblers, rather than problem gamblers fixated on slots. While metrics point to general transparency, Ignition lacks third-party certification of its games’ fairness.

Placing Ignition within a competitive landscape reveals where it excels or lags as an advocate for transparency.

Most surveyed casinos hold Curaçao licenses, although Bovada and Slots.lv lack documented licenses. However, licensing alone is an incomplete predictor of integrity, necessitating further metrics. Ignition provides company ownership details in line with peers.

Bovada and Slots.lv lead in visitor numbers, spins and estimated revenues. However, Ignition still surpasses most competitors, outranked only by the largest brands. Meanwhile, its average visit duration exceeds 28 of 33 casinos benchmarked by SimilarWeb. This indicates Ignition fosters strong engagement despite its smaller size.

Ignition’s 52% high volatility game share is surpassed only by Slots.lv 59%. However, with middling average bets, Ignition likely attracts fewer high-stakes slot players. Its low and medium volatility game proportions closely match competitors. Hence, Ignition’s volatility profile coheres with industry norms.

Ignition’s bonuses elicit a 61% playthrough completion rate, which only 35% of rated casinos exceed as per Casino.Guru. However, its new player retention lags Bovada, Slots.lv and others reliant on bonuses for loyalty. This suggests Ignition could enhance its bonus program to boost engagement.

Unlike Golden Crown and BitStarz, Ignition lacks independent certification of its game randomness. Third-party testing by firms like iTech Labs or GLI represents the gold standard for verified fairness. Its absence is Ignition’s most pressing gap in transparency.

Ignition offers eight Payment Methods, including six cryptocurrencies. While ample for most players, top casinos offer up to 22 options encompassing various e-wallets and prepaid cards. Nonetheless, Ignition provides major credit cards and bitcoin, meeting needs for most patrons.

Analyzing aggregated data reveals overarching trends about the online casino sector:

These patterns intimate that while transparency varies between individual casinos, the wider niche remains rooted in exploiting recreational slot players. With methodical bonus programs and penny slots optimized for high house edges, even well-regulated casinos may aggressively extract player value.

While our data cannot unilaterally separate credible casinos from unscrupulous ones, several best practices emerge:

While dense data provides direction, no solitary metric definitively indicates legitimacy. Discretion remains imperative. Our role is simply shining light so players may navigate wisely towards gaming experiences upholding fairness, choice and entertainment.

With the flourishing of online casinos, distinguishing the genuine from the dubious is an evolving challenge. As advisors, our mission is illuminating that path. By arming players with penetrating insights into casino operations and business practices, data can transform an obscured terrain into navigable territory.

Our analysis centered on Ignition Casino, with its performance suggesting a mostly transparent operator favored by casual players. However, benchmarks against competitors revealed opportunities for improved licensing compliance, game testing and player incentives. More broadly, current industry metrics intimate a niche catering to recreational penny slot players rather than professional gamblers.

While positive progress occurs, true transparency remains piecemeal. Our role persists in scrutinizing metrics, upholding benchmarks and cautioning players accordingly. But data can only guide, not predict. Discretion is still required when gambling online or anywhere. Through ongoing analysis, our aim is to turn that discretion into an enlightened, empowering force. Because behind every datum, statistic and trend lies a player seeking entertainment, value and fairness above all else.

Total Users

> 345,000

Session Duration

13 min 52 sec

Total Spins

> 50 Million

Return to Player %

90.07 %

Player satisfaction rate

22.83 %

Average bet size per user

3.56 $

Average time between withdrawals

16 days

New user registrations

20.19 %

Active users

27.4 %

Users who play with maximum bets

> 4.61 %

Players using bonuses

44.98 %

Users complete wagering requirements

33.11 %

Average deposit frequency per user

5.57

Average time between deposits

22 days

Average withdrawal amount per user

$ 4.97

Most popular time for playing

8:00-10:00

Deposit Multiplier Chart

Discover the power of data visualization to enhance your online casino experience with our innovative deposit multiplier chart. This cutting-edge graph showcases the percentage of players who have successfully multiplied their deposits by 2x, 5x, 10x, and even 100x at various online casinos. By analyzing this insightful chart, you can gain a deeper understanding of your winning odds and make more informed decisions when selecting the perfect casino to suit your preferences.

Volatility Chart

26.07% prefer high volatility games

46.06% prefer low volatility games

27.87% prefer medium volatility games

Users who play with maximum bets

> 4.61 %

Average deposit frequency per user

5.57

Bank

Bank

Real Time Gaming,

Lightning Box,

Spinomenal,

Genesis Gaming,

Spadegaming,

Revolver Gaming,

Year Established: 2016

Company: Lynton Limited

Curaçao is one of the earliest jurisdictions to regulate online gambling. Its licensing process is known for its affordability and efficiency.

332,000 +

Band Raiting

96%

TrustPilot

40%

AskGamblers

60%

CasinoGuru

23%

53,100 +

Band Raiting

67%

TrustPilot

41%

AskGamblers

0%

CasinoGuru

77%

21,400 +

Band Raiting

80%

TrustPilot

44%

AskGamblers

54%

CasinoGuru

77%

40,800 +

Band Raiting

63%

TrustPilot

29%

AskGamblers

65%

CasinoGuru

60%